Key Furniture industry trends in 2026:

- Furniture eCommerce is Accelerating Despite Headwinds: Despite macroeconomic challenges like inflation, supply chain issues, and tariff uncertainty, the furniture industry trends show resilience. Q4 2024 was the best quarter since 2022, and the shift to online furniture purchasing is strong, with the US market leading globally and a high percentage of online searches (62.3%) being transactional (ready-to-buy).

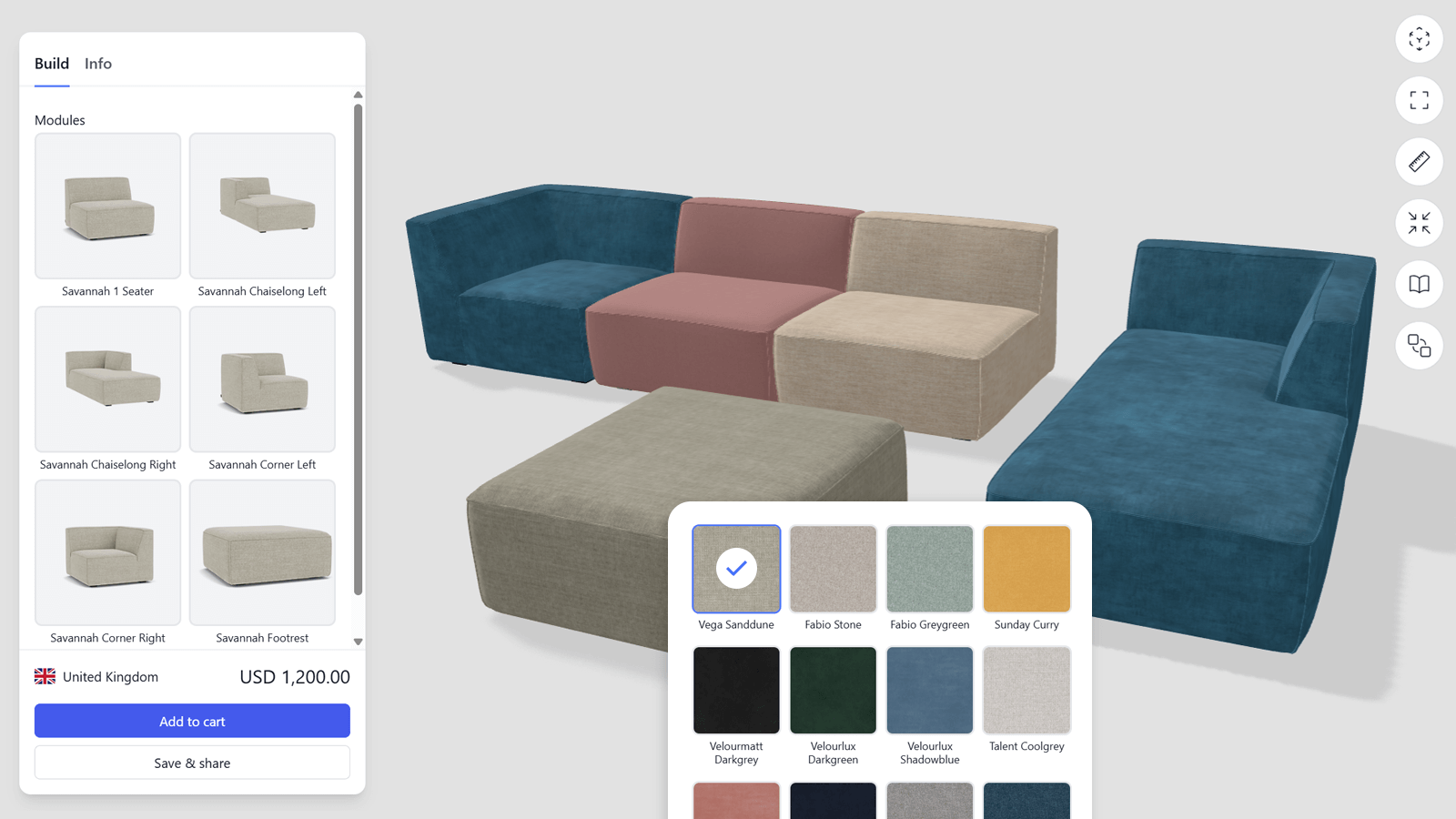

- Digital Transformation is Crucial for Future Success: To capture the spending power of Millennials and Gen Z and to meet the demand for seamless shopping experiences, a major furniture industry trend is the urgent need to invest in technology. This includes expanding the use of 3D product visualization (with 59% of businesses planning adoption) to close the experiential gap, produce content at scale, and drive conversions.

- The Retail Model is Evolving into Omnichannel Experience: Physical retail is not ending but transforming; stores are evolving into "experiential retail" hubs (like "slowrooms") that complement the digital channel. The future requires marrying the online and in-store experience, using technology (like 3D kiosks) to create a seamless, omnichannel journey for the customer.

Furniture businesses have dealt with more change in the last couple of years than in the previous two decades.

The rise in inflation, the persistent issues with global supply chains, and the uncertainty of tariffs have been keeping businesses on their toes. On top of that, the economic and social headwinds have been weighing on consumer confidence. But here’s the good news—despite all of that, Q4 2024 turned out to be the best quarter for the home and garden industry since 2022. It’s a solid reminder that, even in the face of challenges, the industry is finding its footing and thriving in ways we didn’t expect.

While there is genuine optimism about the industry’s performance in 2025, furniture businesses are closely following macroeconomic trends to make informed decisions.

To help you navigate the competitive landscape, we took a closer look at the latest economic developments and analyzed the potential impact they could have on the furniture industry.

Let’s dive in.

Furniture industry outlook — inflation, inventory, and supply chain challenges

The e-commerce boom catalyzed by the pandemic has brought excitement to the digital world. E-commerce as a share of total retail sales had significant growth, which forced businesses to invest more time and money into boosting their e-commerce channel. Now, as the dust has settled, there’s a sense of slowdown, when in fact, e-commerce has continued its growth to the pre-pandemic pace.

.png?width=1320&height=465&name=fredgraph%20(1).png)

1. Furniture e-commerce is on the rise

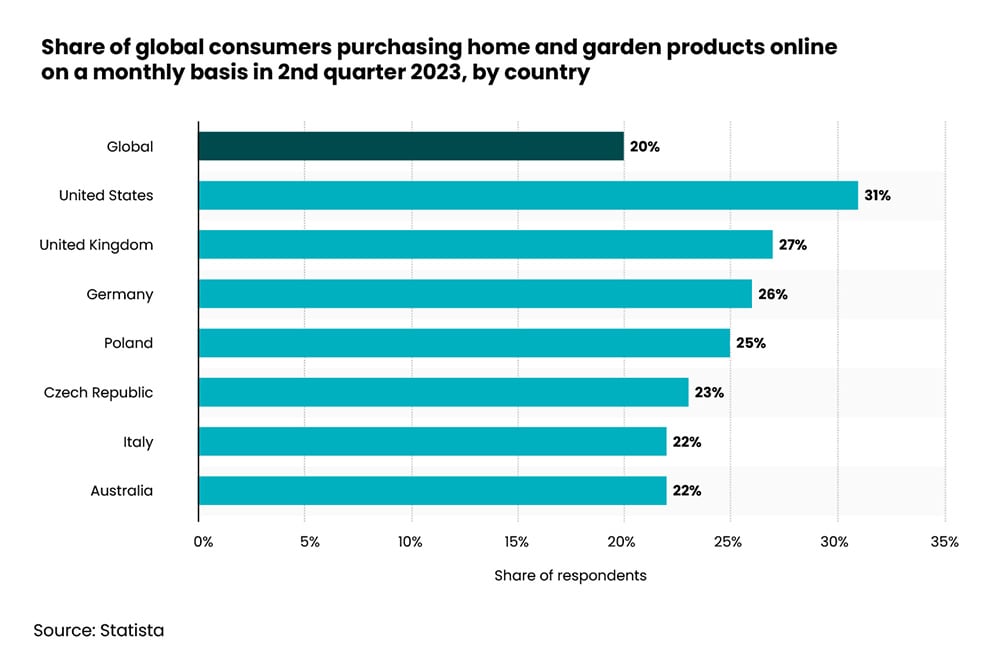

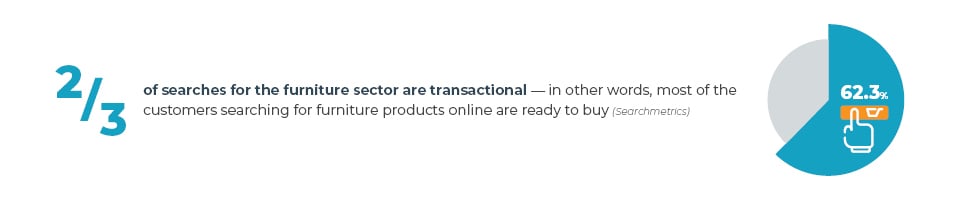

Zooming into the furniture e-commerce realm, in 2024, the United States was the biggest market for furniture e-commerce worldwide, with estimated revenues nearing the 125-billion-dollar mark. China ranked second, with furniture e-retail revenues reaching approximately 45 billion U.S. dollars. According to Statista, a fifth of global shoppers were purchasing home and garden products online on a monthly basis. Data shows that the highest user adoption of furniture e-commerce was in the United States, where 31% of shoppers were buying household furniture online on a monthly basis.

Consumers’ shift to digital has accelerated dramatically — especially in the furniture industry. Unlike in the past, when online browsing was more like window shopping, today, most customers searching for furniture products online are ready to buy. Data from Searchmetrics shows that almost two-thirds (62.3%) of searches in the furniture sector are transactional.

*According to a report from Comscore, the furniture and appliances category was one of the top-grossing and fastest-growing digital commerce categories.

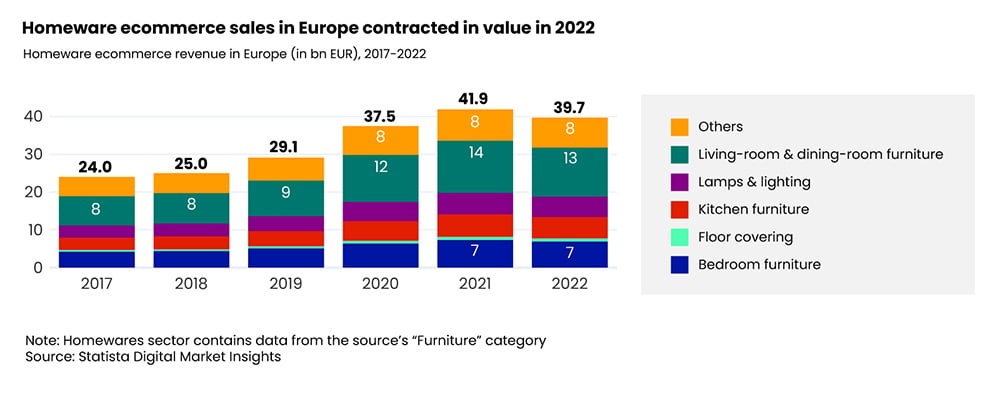

2. The European furniture market growth

According to CSIL (Furniture retailing in Europe 2024 report), the European retail furniture market is worth EUR 165 billion. The homeware sector witnessed dramatic growth during the pandemic when 40% of European consumers invested in their homes. And while the surge had started to correct itself, the market in 2022 was more than EUR 10 billion larger than it was in 2019.

Consumer spending on big-ticket items like furniture has been affected by the rising cost of living and the change in consumer behavior following the pandemic. Despite these challenges, the increased importance of the home since the pandemic is expected to generate new demand for furniture, which is now valued for more than just its functional use.

Europe is the third-largest furniture market globally, following Asia Pacific and North America, and as such it has a significant impact on global furniture production value, market dynamics, and international trade. Europe represents over 25% of the worldwide furniture market due to factors including a high per capita consumption level and over 230 million households.

When it comes to furniture e-commerce, according to the European E-commerce Report, 26% of European consumers have purchased furniture, home accessories, and gardening products online in the last 3 months of 2024.

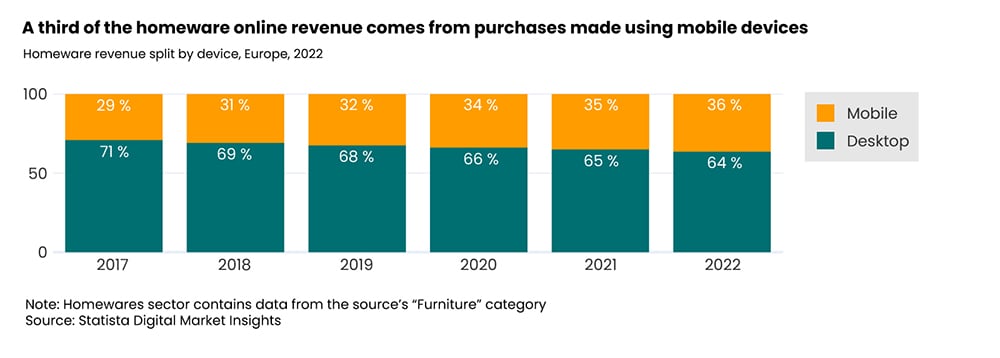

Users are now increasingly comfortable buying online, which can be seen from the fact that one-third of the homeware online revenue comes from purchases made using mobile devices.

3. Prices, sales, and inflation

Economic uncertainty, inflation, and interest rates are the top-of-mind concerns for furniture retailers in 2025, according to a TD Bank survey.

Results showed that 40% of retailers cited economic uncertainty as the biggest concern. Ten percent of respondents identified price increases from inflation, while about 9% cited interest rates as issues their businesses would face in 2025.

Additional concerns cited by a smaller percentage of furniture retailers include price increases from suppliers (6%), continued supply chain disruptions (4%), and reaching new customers or clients (3%).

4. Inventory, tariffs, and supply chain challenges

During the pandemic, supply chain bottlenecks collided with high demand, and as a result, furniture businesses struggled to meet the increased appetite for household goods. However, after the initial excitement and shopping craze, consumer spending has shifted due to uncertainty on a global level, leaving retailers with excess inventory. After the disproportionate waves of (first) demand for furniture and later supply (due to excess inventory levels), things are starting to normalize on both ends.

According to Maison&Objet Barometer, both brands and retailers have normal inventory levels compared to 2023. Moreover, brands are rising to the challenge of changing consumer habits and are focused on launching new products to boost their business. Data shows that 84% of brands confirmed a planned product launch in the first quarter 2025.

The announced 25% tariffs on most goods from Canada and Mexico and 10% on goods from China have once again raised concerns about potential supply chain disruptions.

To understand the proposed tariffs' importance and potential impact, we need to remember that Canada, Mexico, and China are America’s most important trade partners, accounting for 43% of U.S. goods imports and 41% of U.S. exports in 2023. Thus, U.S. tariffs on goods from these countries or reciprocal tariffs have the potential to hurt U.S. businesses and consumers alike.

To mitigate some of the risks and minimize the potential impact of tariffs, retailers started frontloading some products. However, that can lead to increased challenges because of additional warehousing and other related costs.

Furniture manufacturers also began diversifying their supply chain, focusing on sourcing materials from regions outside of China, to maintain low lead times and protect from additional supply chain disruptions.

One of the challenges that manufacturers can face is that the U.S. lacks the raw materials necessary to fully replace imports. Moreover, building a domestic supply chain requires a big upfront investment.

Uncertainties around tariffs are reshaping global trade flows, forcing container logistics players to rethink sourcing strategies and market access. A recent Container xChange survey revealed that 81% of container logistics businesses are actively building new partnerships beyond traditional trade routes.

According to the report, as U.S. buyers look beyond Mexico and Canada for imports, there could be increased demand for alternative suppliers in Asia, South America, and Europe, reshaping traditional container routes.

Why does this matter to furniture businesses? The potential introduction of tariffs could lead to higher consumer prices, forcing businesses to either absorb the costs or pass them on to the end consumer.

Furniture industry predictions and expectations

There’s no doubt that the world is in a complex economic situation. Furniture players have already felt the impact of the changing business landscape. The question is whether there’s a place for optimism.

Retailers and manufacturers are cautiously optimistic about 2025, even as the rumblings of tariffs have everyone on edge.

According to a TD Bank survey, nearly half (48%) of furniture retailers are confident that home furnishing purchasing will increase in the first half of 2025. Moreover, retailers are excited about the new merchandise the manufacturers plan to introduce in 2025.

Data from the same survey shows that 26% of furniture retailers strongly believe that customers will be seeking living room and dining space furnishings. When those who somewhat agree are added in, this number goes up to 64%.

The results from the TD Bank survey confirm that furniture e-commerce is going strong. According to the data, 52% of furniture retailers strongly or somewhat agree that they are seeing more interest among consumers in online shopping.

Euromonitor International predicts that the global economy will grow steadily by 3.2% in 2025, and global consumer expenditures in household goods and services will grow by more than 2.5%.

After a year of postponed purchases, consumers are gearing up to make good on their furniture shopping plans in 2025. As reported by the Nationwide Group, there’s a clear split in when consumers expect to fulfill those delayed purchases, with some categories seeing more action in the first half of 2025, and others pushed further into the second half as shoppers continue to navigate shifting prices and new economic realities.

Let’s look at the breakdown:

- Sofas/Sectionals: 40 percent first half, 37 percent second half

- Mattresses: 43 percent first half, 36 percent second half

- Bedroom Furniture: 38 percent first half, 38 percent second half

- Reclining Chairs: 35 percent first half, 42 percent second half

- Outdoor Furniture: 30 percent first half, 40 percent second half

Even though macroeconomic uncertainty will prompt changes and fluctuations throughout the year, furniture companies must focus on reconfiguring and optimizing their businesses for long-term results.

The bottom line is that the industry has faced similar challenges before, and there are still plenty of positive trends pointing in the right direction for furniture businesses in 2025.

*The key is focusing on what you can control and adapting to the things you can’t.

How to prepare for 2026 and beyond

The news about the macroeconomic outlook continues to dominate the headlines. And while some businesses are waiting on the sidelines, others are moving decisively and quickly to develop a response.

Companies are already expanding their horizons to capture future growth opportunities, with the understanding that bold steps now can increase the potential to lead in the future.

We took a closer look at the developments in the furniture industry to understand what leading furniture companies are doing now to prepare for 2025 and beyond. Here are the takeaways:

1. Understand the differences between generations

Furniture businesses are bullish because of an upcoming tailwind: Millennials. Despite the housing market challenges, Millennials will be the driving force for years to come. According to the 2024 Profile of Home Buyers and Sellers, published by the National Association of Realtors (NAR), the typical first-time buyers’ median age reached an all-time high of 38 years old. In the 1980s, the typical first-time home buyer was in their late 20s.

Why should furniture businesses focus on Millennials and Gen Zs? Millennials are in their peak earning years, and many of them still haven’t bought their first home. Gen Zs, on the other hand, are an emerging spending powerhouse.

Research from Tink shows that around three-quarters (73%) of Millennials and 64% of Gen Z surveyed want to invest more in quality purchases that will last. These generations are driving a shift toward ‘accessible luxury’ and their top priorities when shopping are quality, sustainability, and secure, seamless shopping experiences.

What does it mean for furniture businesses?

Tapping into the buying power will require some adjusting. Millennials are tech-savvy, and they digest media differently. As a digital native generation, they are prone to online shopping. Furniture businesses that want to capture Millennials and Gen Z's attention have to:

- Introduce clean-lined furniture products (contemporary looks, with clean finishes and natural materials)

- Focus on high-quality product visualization

- Create fresh, visually appealing content for different channels

2. Redefine the furniture e-commerce experience using the power of technology

Success in furniture — or almost any line of business in a digital-first world — depends upon technology. And furniture brands and retailers are aware of this. According to a Forrester study, the appetite for emerging technologies is high. Results from the study show that 52% of furniture businesses are planning to adopt augmented reality (AR), 59% of furniture businesses are expanding the use of 3D product visualization, and 78% of furniture leaders see AI for customer support as impactful on sales.

The rapid digitization of commerce has completely transformed customers’ expectations. To cater to their needs, retailers are improving the e-commerce experience to meet customers where they are.

The rapid digitization of commerce has completely transformed customers’ expectations. To cater to their needs, retailers are improving the e-commerce experience to meet customers where they are.

The British furniture retailer Sofa Club puts style-savvy customers and their needs at the center of the business. The way people shop for furniture has changed. Sofa Club transformed its business to deliver a seamless shopping experience.

“For most people, buying a sofa is going to be one of the biggest investments of their year; this is something they will be living with for years to come. Historically, a large percentage of consumers want to touch and feel a sofa in person before committing to the purchase online; however, we have seen this behavior shift dramatically post-COVID. Our focus is now on delivering an outstanding online experience with our products and providing the customer with enough information, content, and technology that gives them the same level of confidence as seeing it in real life. Social proof has also become more important than ever, and we are working hard to ensure potential customers are aware of feedback from existing customers through reviews and user-generated content.”

- Louis Rose, Founder, Sofa Club

What does it mean for furniture businesses?

Put your online shopping experience on top of your priority list. Make sure customers have a seamless shopping experience as they navigate through your website, from your product feed and product listing pages to the recommendations and checkout page—reassure customers they are making the right decision. Some action points that can help in this process:

- Boost customers’ confidence with 4K product visuals

- Remove friction from your checkout process

- Focus on gathering social proof and use it to your advantage

3. Fuel your furniture marketing with 3D content

Furniture retailers have finally realized there’s no room for legacy website experiences and platforms never designed with our digital age in mind. Retailers will need to move beyond the current 2D focus of e-commerce to prepare for a more social and immersive future of shopping.

The need for fresh content across different platforms has hit an all-time high. Furniture brands, on the other hand, have been struggling to balance between the amount of content they produce and the total costs. With 3D technology, businesses can create 3D lifestyle imagery at scale without breaking the bank, making it a critical component of their effective furniture marketing strategies.

The UK design-led furniture brand Swoon Editions uses 3D technology to showcase its products in context and at scale with customizable lifestyle imagery. The ability to easily generate and iterate upon photorealistic lifestyle imagery allows Swoon to serve a wide range of photorealistic content in their email marketing campaigns, social media, product feeds, and many other touchpoints.

Source: Milled

Source: Milled

“Cylindo has been transformational for Swoon in terms of how we distribute our digital content. Prior to the partnership we were expending lots of time and effort producing hundreds of photographic images across multiple digital channels. Now we can design, produce and push content to our website in a matter of weeks, greatly improving efficiency whilst maintaining consistency. The 360 viewer, 4K zoom, and lifestyle imagery features allow us to serve a wide range of interactive content from a single 3D asset which aims to both inspire and manage our customers' expectations seamlessly.”

- Josh Rushby, Head of Marketing, Swoon

What does it mean for furniture businesses?

Furniture businesses that want to get ready for the new chapter of furniture shopping have to embrace 3D product visualization. In 2022, Google introduced 3D visuals of home goods to its search function. The results show that shoppers engage with 3D images almost 50% more than static ones. Moving forward, 3D product visualization will become the norm across industries.

- Introduce 3D technology to your product visualization strategy

- Create a balance between 3D lifestyle imagery and traditional photography

- Use 3D lifestyle imagery to produce content for different channels at scale

4. Boosting furniture sales with advertising and marketing

Another thing furniture businesses need to change is their approach toward advertising and marketing. During the two pandemic years (2020–2021), there was no need to promote furniture because online sales were skyrocketing. Things have changed.

Furniture businesses need to get back out there and promote and advertise their products. However, promoting products requires the agility to act quickly and equip both your sales reps and your e-commerce website with assets that boost customers’ confidence to make a purchase. Here’s where 3D product visualization software comes in handy.

The luxury Canadian brand Monte understood the importance of promoting new styles and colors quickly, and they introduced a 3D product visualization, which made new product launches much easier.

“We partnered with a 3D product visualization partner right when COVID-19 hit, in times of large uncertainty, which has proved to be the right decision. With the amount of personal customization available with our line, having a 3D product visualization partner in our corner enables us to move quickly with new styles and colors and offer them to market in a much faster timeframe. The features we require at scale are extremely time-consuming using traditional photography.”

- Ralph Montemurro, CEO and Founder, Monte Design

What does it mean for furniture businesses?

Furniture businesses have faced an array of challenges in the past couple of years. The competition is fierce, and it’s hard to stand out without well-thought-out marketing campaigns. Here are some things to consider:

- Understand what your target audience needs

- Offer customers the ability to customize products

- Use 3D technology to supercharge your furniture marketing campaigns

5. Invest in experiential retail

The unprecedented boom in furniture e-commerce sales forced many to believe that this would be the end of physical retail. Instead, we saw some of the leading retailers expanding their physical footprint. The reason? E-commerce has transformed the role of brick-and-mortar stores.

Moving forward, physical stores will still play a critical role in pushing business objectives and commercial targets forward — but this time, with a spin — the store will become the hallmark of experiential retail.

The UK furniture and homeware brand Loaf is known for its Shacks — “slowrooms” (not showrooms) where customers can fully immerse themselves and enjoy the furniture shopping experience. What makes Loaf different from regular furniture showrooms are the added features customers love, such as a mattress testing arena, swatch stations, a selection of small homewares, retro arcade games, sweet stations, a chill-out area, and even a biscuit bar.

What does it mean for furniture businesses?

Furniture retailers and DTC brands that want to keep (and boost) foot traffic in their showrooms have to reinvent their retail experience and offer something unique. Here are some ideas to keep in mind:

- Marry up your in-store and online furniture shopping experience

- Use technology in-store to create an endless aisle experience

- Focus on creating a unique retail experience and compensate for the lack of square footage with tablets and kiosks equipped with 3D product viewers

Ready to reinvent your furniture business?

The consumer shift toward e-commerce has opened the door for a long-overdue great retail reset and digital transformation to create a seamless omnichannel shopping experience.

Thriving in this new furniture e-commerce landscape will require unique insight and action. It’s vital for furniture businesses to understand what consumers expect when shopping online, their behavior changes, and their future expectations.

Investments in 3D commerce, rich e-commerce merchandising, and the store of the future can help companies address the rapidly shifting customer preferences. This will require furniture brands to transform their thinking and make long-term commitments, but it could also change the way they conduct business forever.

Ready to adopt 3D product visualization as part of your business strategy?

Leading companies worldwide are using Cylindo to deliver superior omnichannel product experiences for their customers. Want to see why and what you can do with it?