Consumer behavior and the business environment are changing fast — and it’s critical for companies to keep a pulse on both. And since the holiday season presents a major opportunity for most companies, how they navigate these uncharted waters will make or break their businesses.

With these changes in mind, retailers are already gearing up for the holidays.

Inflation, supply chain problems, and labor shortages are just some of the challenges businesses are facing ahead of the holiday season. Aware of the economic changes, customers are looking to stock up on discounts to beat future price hikes.

The big question for retailers is: how can you get ready for the holiday season and deliver an excellent customer experience to wrap up the year with success?

To help you find the answers, we’ll go through changing shopping patterns, predictions for the new business landscape, and what you can do now to prepare for the holiday shopping season.

Holiday shopping patterns have changed

Despite the supply chain issues, retailers pulled off a successful 2021 holiday season. According to Deloitte, the total holiday retail sales in 2021 increased by 8.5%, the largest annual increase in 17 years.

Retailers realized that some of the pandemic shopping trends had settled into post-pandemic habits. Here are some of the patterns we noticed last holiday season.

Fewer discounts

Tight inventories reduced discounts in 2021. Unlike previous years, shoppers said they were finding fewer discounts last holiday season.

According to Adobe, except apparel and toys, every key category saw less aggressive discounts in 2021 compared with the prior year. The overall level of holiday discounting was 9% in 2021, down from 14% in 2020. For furniture/bedding, the discounting was 2% compared with 4% in 2020.

Click and collect

Ever since the pandemic, customers place more value on convenience and speed when shopping, evidenced by a significant shift in click-and-collect orders.

Data from eMarketer shows that this preferred shopping method from 2020 remained popular throughout 2021. Though click and collect declined slightly as a percentage of e-commerce orders compared with 2020, it still drove nearly one in four online transactions.

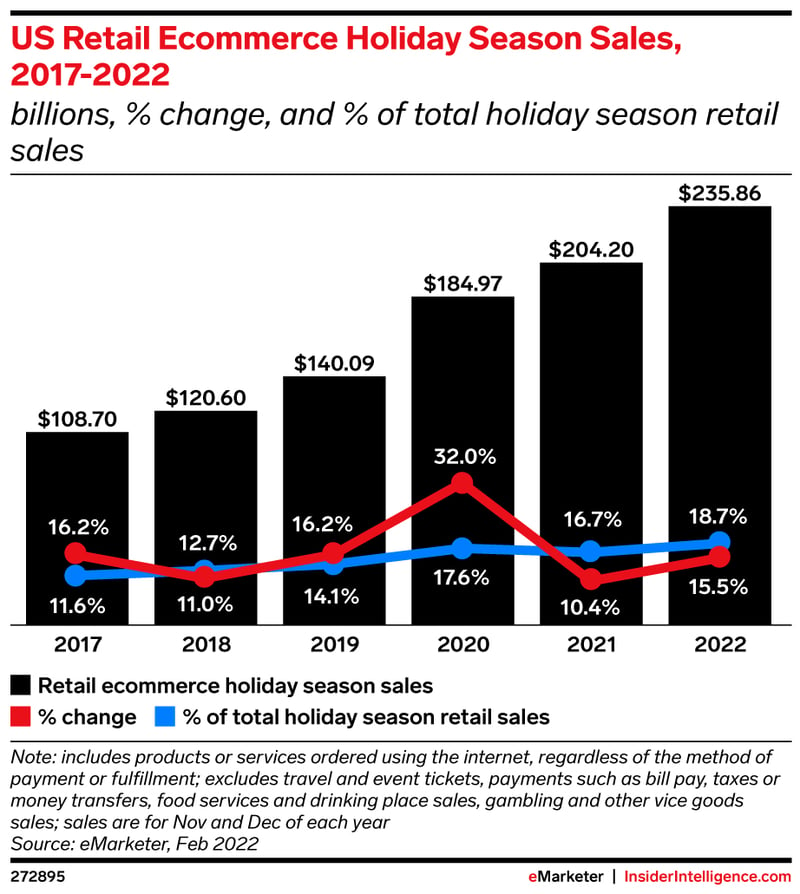

E-commerce growth

After the dramatic 32% surge in 2020, e-commerce had a solid performance last year. During the 2021 holiday season, e-commerce growth reached double digits, rising 10.4% to $204.20 billion.

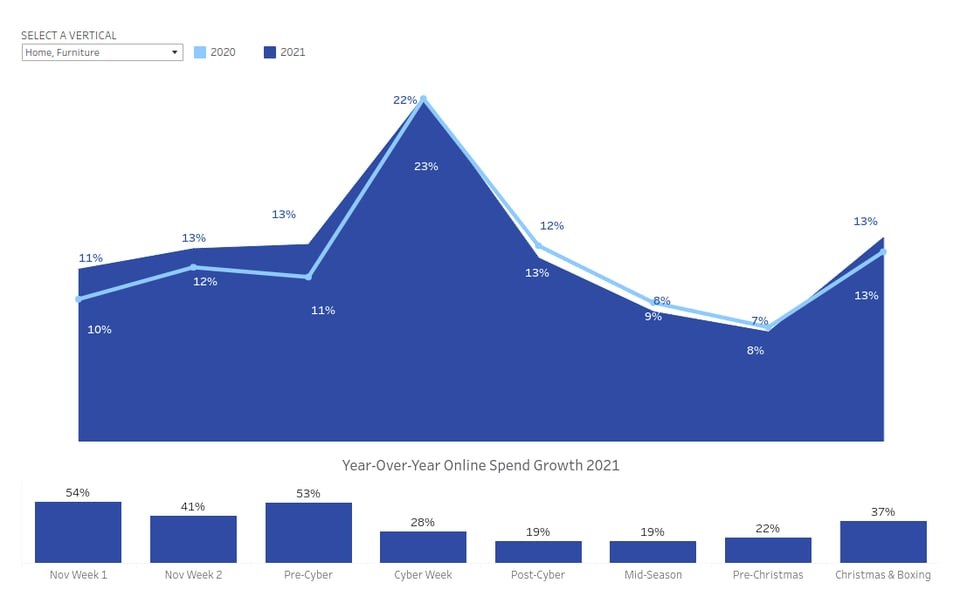

But things were slightly different for furniture businesses. The industry experienced a boom. According to Salesforce, home furniture was one of the three top-performing product categories in online sales growth across November and December 2021, with a 34% increase.

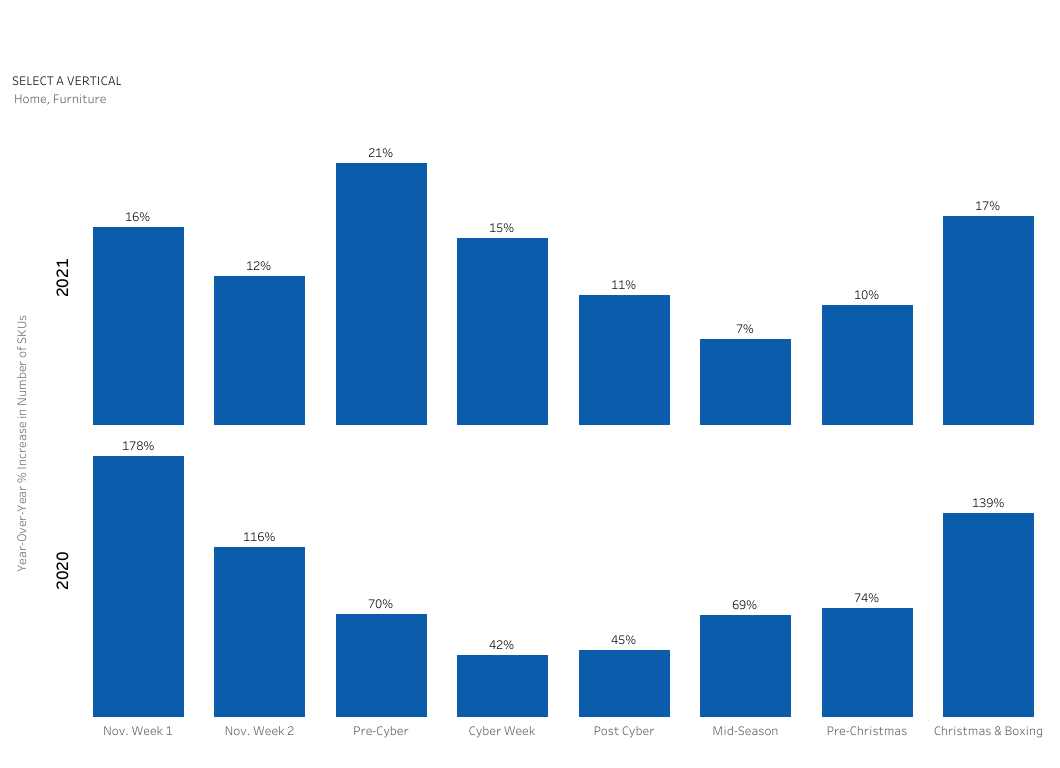

Furniture businesses noticed the highest online spending during the first few weeks of November, especially ahead of Cyber Week. The holiday spending activity followed a similar trend during the 2020 holiday season.

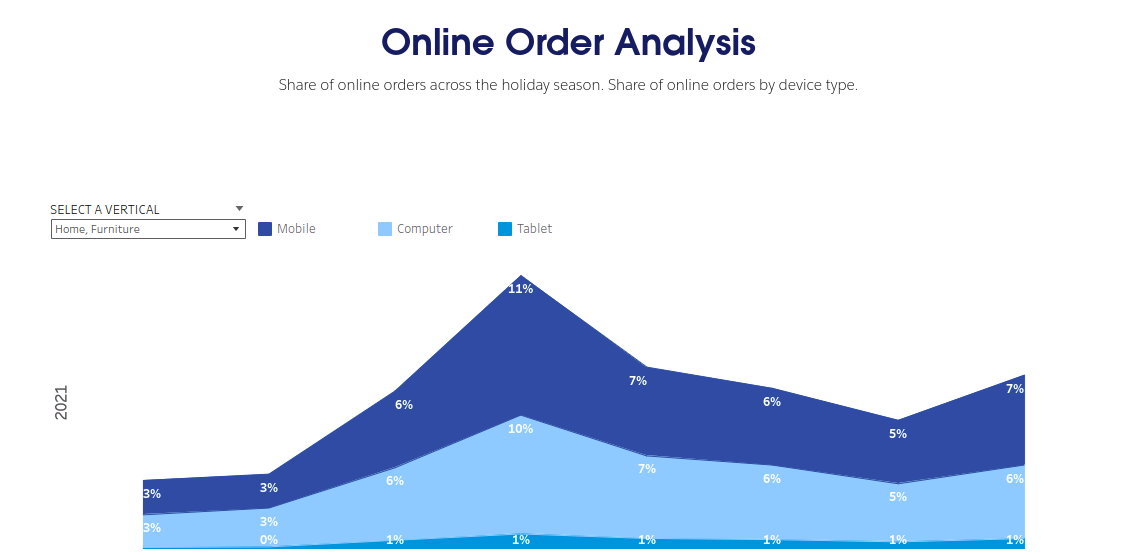

M-commerce

Mobile is slowly becoming a major channel for shopping. According to Adobe, over the 2021 holiday season, 61% of retail visits and 43% of online sales came via smartphones, accounting for $88 billion overall.

Contrary to what many believe, mobile is a popular channel for furniture buyers as well. Data from Salesforce shows that the average share of online orders through mobile during November and December 2021 was 6%. This number goes up to 11% during the peak season, especially during Cyber Week.

The increase in website traffic coming through mobile devices, as well as the higher number of online orders using mobile, presents a new challenge for furniture retailers: how to create a delightful mobile shopping experience to convert more buyers.

Holiday shopping season predictions

This year is unique for a variety of reasons. For one, the economy isn't doing so great, and consumers may be less inclined to spend a lot of money. As such, retailers are testing out new things for the holiday shopping season this year.

Assuming what will happen in the last months of 2022 seems to be a fool’s errand given all the uncertainties and economic changes, but taking all the information into account, we’re going to lay out the holiday shopping season predictions for 2022.

Holiday sales will start early

The supply chain woes in the last two seasons of pandemic-driven holiday shopping brought lasting changes in customers’ expectations around the holiday promotional calendar and the best deals.

There’s no way around it — with the advent of always-on, digital-first shopping, future shopping will likely occur earlier. But this holiday season, retailers will have to take one more circumstance into consideration: inflation.

With the frequent warnings that inflation will get worse by the end of 2022 and the year after, customers are looking to stock up on discounts and beat future price hikes.

According to Salesforce research, 42% more shoppers worldwide and 37% more in the U.S. plan to start buying gifts earlier — the biggest inflation-related behavior change noticed during the research.

It seems that inflation is top of mind for the upcoming season. Data from Numerator shows that nearly nine in 10 (89%) of consumers expect inflation to impact their 2022 holiday shopping — 59% expect the impact to be moderate or significant.

The fading effect of the Cyber Five

The early start of the holiday season means it will be longer and flatter, with less spending concentrated during the Cyber Five period (the days from Thanksgiving through Cyber Monday).

Insider Intelligence predicts that Cyber Five’s share of holiday e-commerce sales will decline from 16.9% to 16.4% and well below the 2019 high of 20.0%.

Customers that want to avoid further price increases and delayed delivery will make their purchases early on. As a result, the demand will force retailers to kick off the season early instead of waiting for the Cyber Five.

E-commerce and m-commerce will continue to rise

The new decade brought significant changes in the retail world. E-commerce growth surged, cementing new digital habits. It’s safe to say that there’s no going back. As customers get used to online shopping, e-commerce will grow further.

According to Insider Intelligence, e-commerce will rise 15.5% to $235.86 billion. M-commerce will also continue to grow, hitting $116.98 billion, or 49.6% of overall e-commerce sales.

But what about the furniture industry? It seems that the shift to online shopping is not fleeting. McKinsey forecasts a 30% growth in customers buying home furnishings online even after the pandemic.

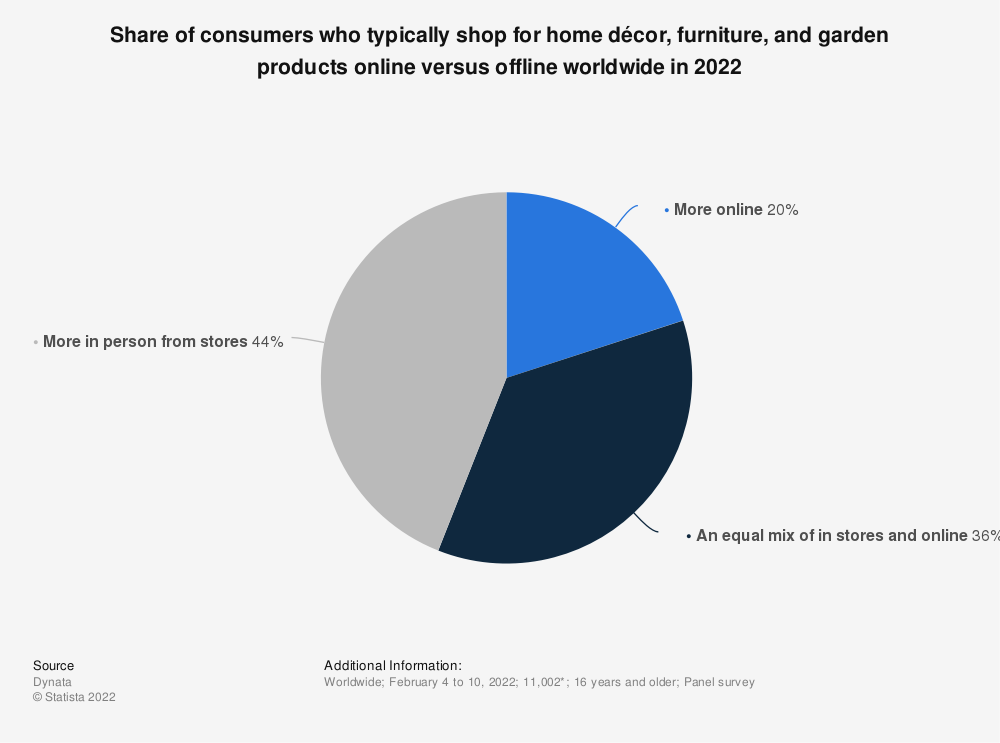

Another research from Statista shows that in 2022 about a third of consumers worldwide stated they frequently purchased home décor, furniture, and garden goods via online as well as offline channels.

About one in five surveyed consumers said they more commonly bought furniture products online. This behavioral shift means we can expect an increase in furniture e-commerce sales this holiday shopping season.

Customers will focus on experience and value rather than loyalty

With rising gas prices, food shortages, and double-digit inflation on the horizon, customers are forced to shift their shopping behavior. Half of the shoppers are expected to switch brands to save money, according to Salesforce. In other words, 2.5 billion shoppers across the globe might make their purchasing decisions based on an offer that better fits their budget.

Things are no different for the furniture industry. A recent Provoke Insights trends study found that less than a third of customers are loyal to a furniture brand.

Results show that loyalty to a furniture brand is not high, and most consumers buy from various companies. The lesson for furniture businesses is that to attract new and retain old customers, they need to focus on offering value and create a delightful end-to-end shopping experience.

5 tips for getting ready for the holiday shopping season

There’s no doubt that the holiday season will be different from everything we’ve seen so far. Does that mean that furniture businesses will be caught in a vicious cycle of never-ending price discounts to win over customers? Not necessarily. To avoid having to compete on low prices alone, furniture players should prepare exclusive offers and engaging shopping experiences and instill confidence.

1. Give exclusive offers

Customers crave exclusivity. Getting access to a unique experience or a limited-series product makes them feel special and motivates them to make a purchase. Exclusivity is especially important to digital-first and digital-native generations.

The Connected Shoppers Report from Salesforce shows that millennials and Gen Zers value exclusive access to limited products and experiences nearly two times more than Gen X and baby boomers.

For almost half of customers (48%), the main reason they prefer online furniture shopping is the ease of purchase. For 24% of customers, online is a preferred shopping method due to the availability of more inventory.

Data from Salesforce shows a significant growth in available products for purchase during the holiday season. The triple-digit growth in 2020 can be attributed to the first pandemic holiday season when there were strict physical distance rules and lockdowns on a global scale.

Even during the 2021 holiday season, there was an average 13% increase in available products online.

The bottom line is that giving customers exclusive access to products is a great way to stand out from the competition. You can achieve the same goal by offering a delightful experience.

2. Create an engaging online shopping experience with 3D

The surge of furniture e-commerce sales brought fierce competition in the space. Many furniture businesses’ websites got a fresh coat of paint in an effort to create a delightful shopping experience.

The number of retailers leveraging the power of 3D product visualization services has increased significantly, especially since the pandemic. The influx of digital twins of products in the digital space has opened a new chapter in the retail world: 3D commerce.

The new way of shopping powered by the use of 3D product visualization opened up a new chapter for the furniture industry. The furniture retailer Mitchell Gold + Bob Williams witnessed a 60% lift in upholstery product sales after implementing 3D product visualization.

Having high-quality 3D visualization on your product detail page is table stakes nowadays. And while some furniture businesses are waiting on the sidelines, others are moving decisively and quickly to futureproof their businesses with 3D product visualization.

Unlike traditional photography, 3D technology allows businesses to visualize furniture without having to manufacture the product in all available options and fabrics. In a business environment pressed by supply chain issues, this can be a great advantage in helping furniture companies save time and money.

3. Use AR to remove customer concerns

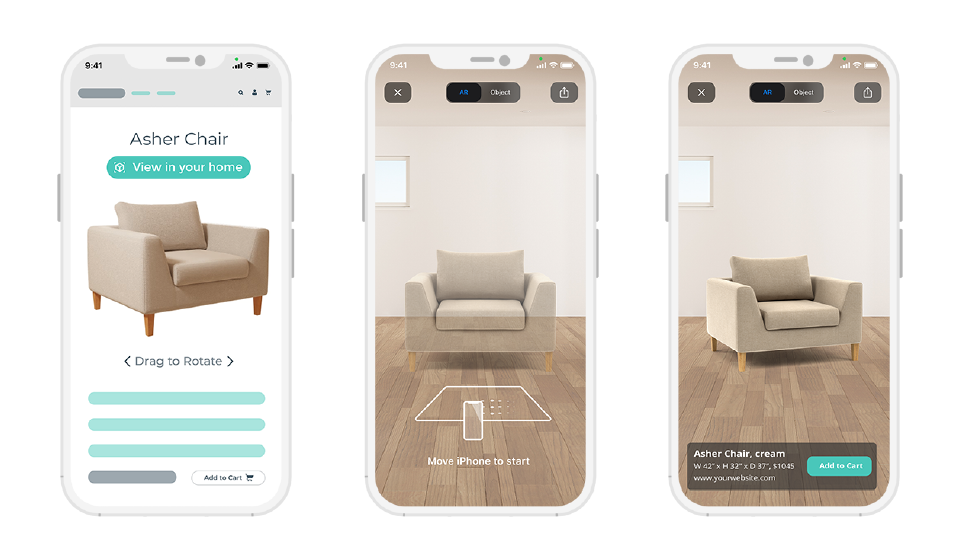

Augmented reality (AR) is nothing new. People are constantly interacting with AR through filters on social media. But this technology is not just for fun. AR has the potential to revolutionize online shopping. As reported by Retail Dive, 80% of customers said they feel more confident in their purchases when using augmented reality tools.

AR is already available across different industries. Furniture is one of them. According to Deloitte, furniture is in the sweet spot for augmented shopping capabilities because it has product sets that are highly standardized with high opportunities for customization. As a result, it has a positive ROI and potential for widespread adoption.

AR is especially interesting for digitally native generations. Data from Statista shows that more than nine in 10 Gen Zs are willing to see what a piece of furniture or decoration would look like in their home using AR.

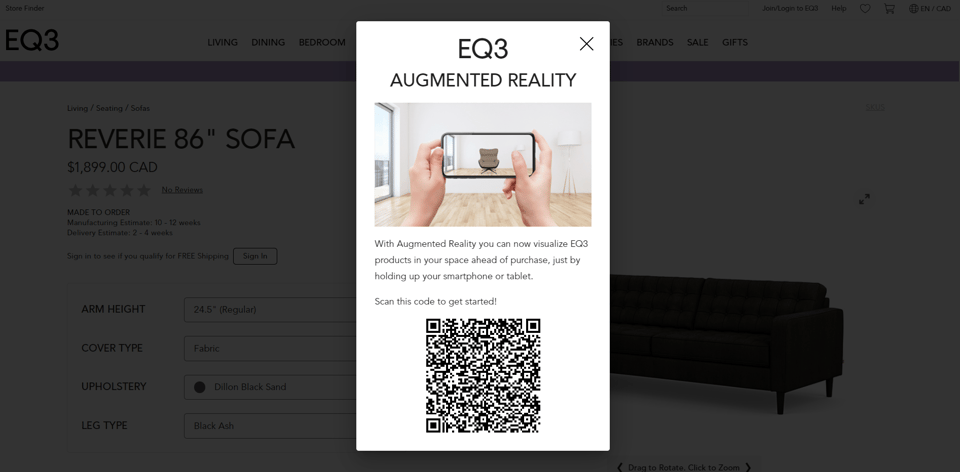

The Canadian furniture retailer, EQ3, found that a buyer using AR has a 112% bigger conversion rate compared to someone that doesn’t. What’s more, AR users have two times higher average order value (AOV).

EQ3's product page with QR code that leads to web-AR on a mobile device

Adding augmented reality to your product pages can help you remove customer concerns and boost sales during the holiday shopping season. One thing to keep in mind is that web-native AR removes friction and creates a delightful shopping experience. Providing customers the option to visualize furniture using augmented reality without downloading an app adds a layer of convenience to the experience that customers will want even after the holiday season.

4. Focus on speed

One thing that remains constant throughout the years is the fact that seamless user experience is one of the most important aspects of shopping, both online and in-store. Long queues or complicated and slow checkouts can kill your business.

According to a study by Amazon Web Services, e-commerce businesses leave 35% of sales on the table due to poor user experience; this translates to roughly $1.4 trillion worth of sales. Additionally, in a Milliseconds Make Million report by Deloitte, they found that a 0.1-second site improvement in retail led to an 8.4% increase in conversions and a 9.2% increase in AOV.

As one can imagine, this is very relevant during the holiday shopping season. People tend to be more sensitive because they want to spend more time enjoying the holidays instead of dealing with slow e-commerce websites or crowded stores.

5. Deliver an endless aisle experience in-store

No matter how much e-commerce will grow in the upcoming years, stores will always remain an important pillar for furniture businesses. But the role of stores will evolve, focusing on experiential retail.

Some of the leading furniture retailers elevate their in-store experiences by leveraging the power of 3D.

Equipping your stores with tablets and kiosks allows you to use 3D product visualization software to give customers an overview of their favorite sofa in all available colors and fabrics, overcoming the issue of a limited physical footprint.

An endless aisle is a retail concept of using kiosks and tablets in-store that allow customers to browse and order products that are not showcased in-store. They can even order products that are out of stock.

This is another way to enhance the customer experience and bridge the online-offline gap.

What's next?

Consumers are starting their holiday shopping earlier than the typical November timeframe. With furniture being so reliant on manufacturers and shipping, this is more prevalent in this industry. Retailers should get ahead of this shift early on, implementing digital functionality earlier than originally planned to ensure things run smoothly by early fall when shoppers start their holiday shopping.

The behaviors and demands of consumers are changing frequently, and if you can’t keep up with these consumer habits, you may lose them to competitors who do.

Ready to reinvent your online furniture shopping experience with the power of 3D product visualization?